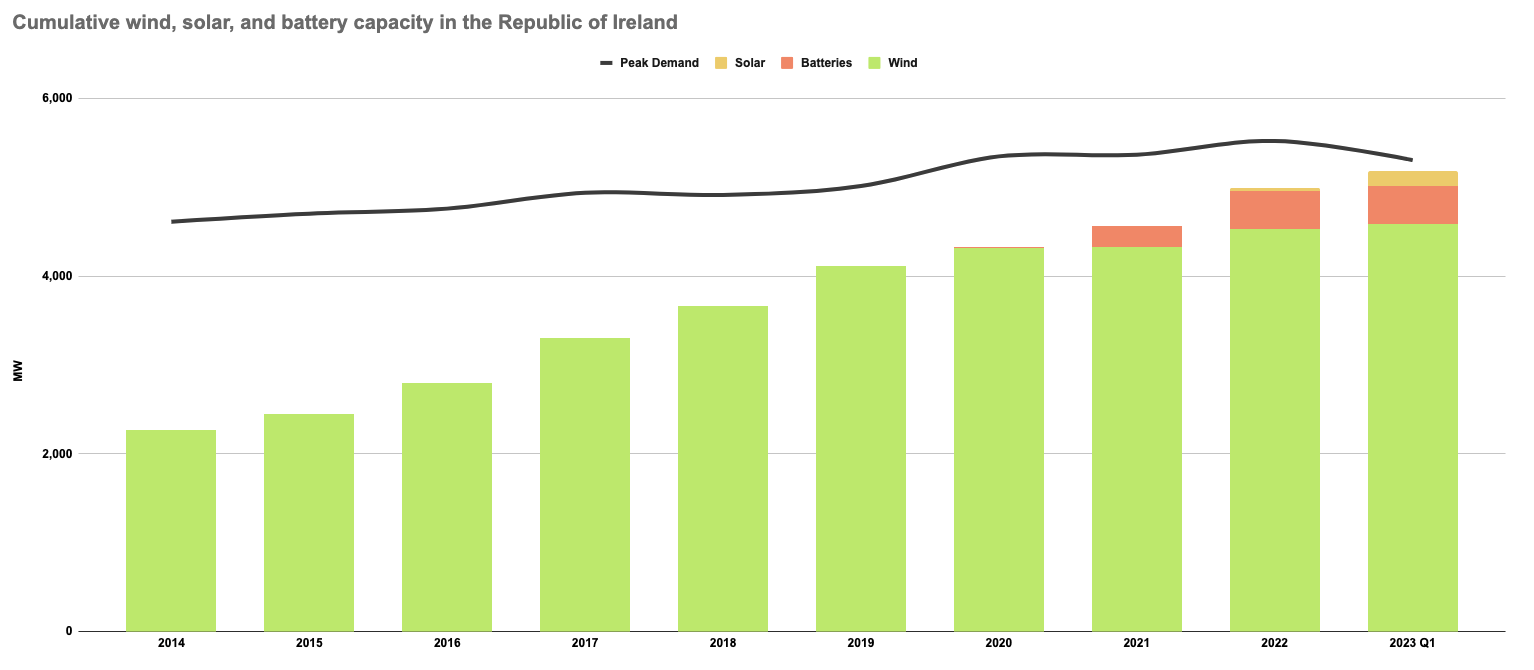

Since we started the Irish Energy Bot, the focus has largely been on wind energy, as wind makes up the vast majority of renewable generation capacity on the island: wind power met 35% of Ireland's (the Republic of Ireland and Northern Ireland) electricity demand in 2022 and 38.4% during the first 4 months of 2023. However, based on recently published information on connected capacity, it's great to see solar and battery energy storage show up on the capacity breakdown chart (below) as well.

The chart above shows the connected capacity of utility-scale solar in the Republic of Ireland is 164MW, and meanwhile 449MW of battery energy storage has also been deployed. Looking at the capacity trend of inverter-based resources (wind, solar, and batteries) over the last 10 years, solar and battery deployments are recent.

The additions of solar and batteries are critical. A diverse portfolio works well to decarbonize the grid. These batteries can currently discharge from 30 minutes to 2 hours. That might sound little, but given the right incentives, short-term energy storage can be powerful while the grid has the most needs during peak hours.

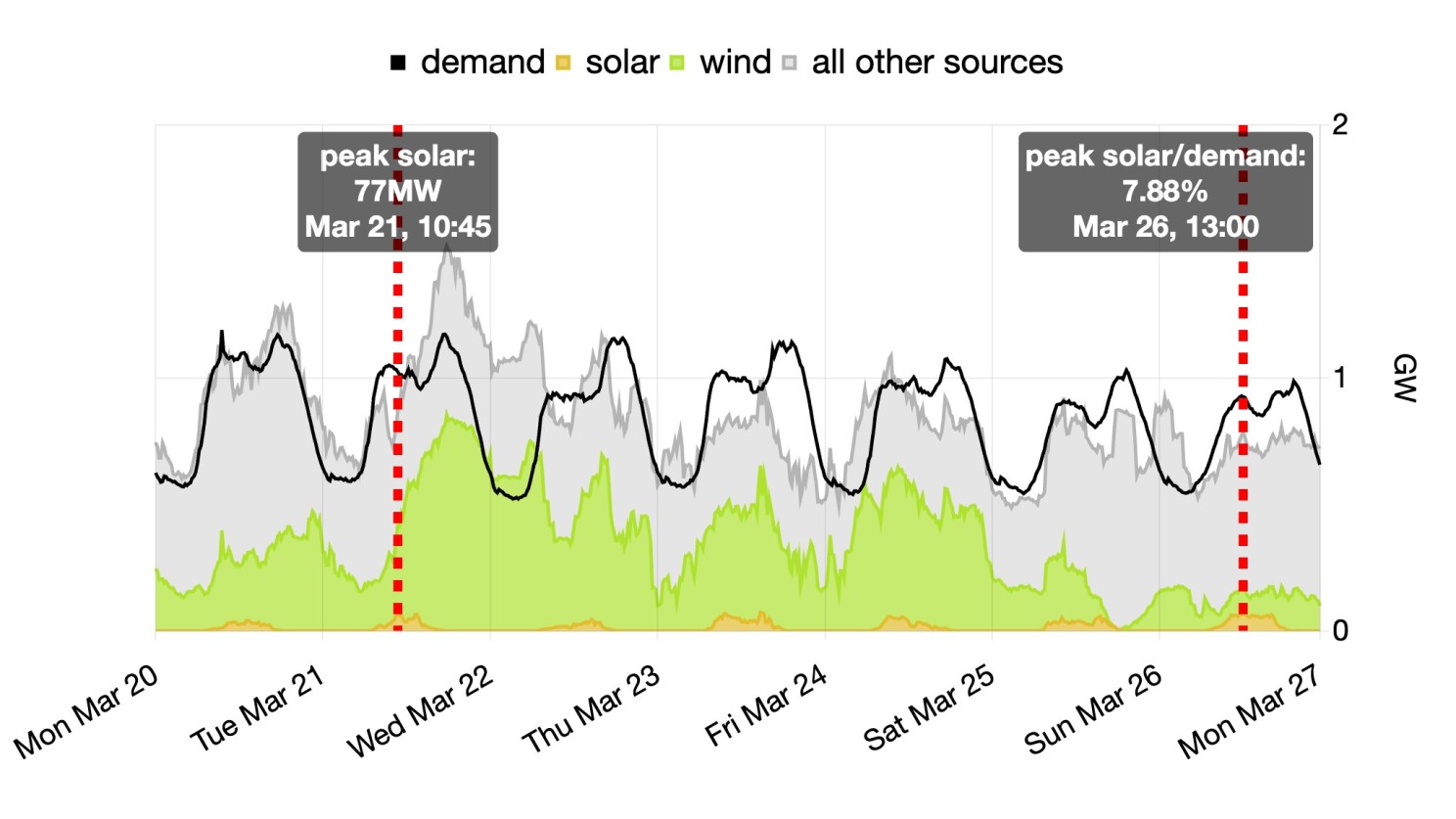

While the first utility-scale solar power plant in the Republic of Ireland was connected in 2022, Northern Ireland already had 118MW of solar. Solar met almost 2% of electricity demand in Northern Ireland in 2022. Below is an example of a recent week with relatively strong solar performance in Northern Ireland.

Generation breakdown in Northern Ireland, March 20 to March 26, 2023

Generation breakdown in Northern Ireland, March 20 to March 26, 2023

While 6GW of installed wind/solar/storage capacity might not sound high to people accustomed to larger market sizes, it's important to remember the island of Ireland is not yet interconnected with the Continental Europe grid. That means it's extra challenging to reach a high level of renewable integration on the grid, while managing inertia and stabilizing frequency levels.

Since 2022, the Irish grid can run on 75% variable renewable generation. This limit has been raised from 50% in 2011 to 75% in 2022, which is a commendable feat. EirGrid's (Ireland's grid operator) next target is to increase the max instantaneous share of inverter-based resources to 95% by 2030.

When comparing EirGrid's max instantaneous inverter-based resources (wind, solar, and batteries) share in total generation with ERCOT and CAISO, we can see an upward trend in EirGrid and ERCOT. While CAISO's limit seems to remain flat over the last few years, it is still higher than ERCOT.

Among these 3 markets, EirGrid faces the most challenging conditions to integrate renewables, since it's not part of a larger interconnect like CAISO, and being a small grid (peak demand of 7GW in Ireland vs. 80+GW in ERCOT) means more issues with inertia and frequency stability.

Despite the disadvantages, EirGrid manages to be more advanced in renewable integration than other markets. We are excited to see how the grid evolves in Ireland.